An Alternative Approach to Deep Tech VC

Marrying early YC's goals with systems from the mid-20th C. deep tech pipeline

This post is an accompaniment to Tony Kulesa’s excellent piece on the history of Y Combinator.

Many in Silicon Valley think of Y Combinator (YC) as the sum of its services. The services are, in short: cash, a network, and guidance for early-stage (mostly software) founders. The YC model and its effectiveness have become widely known and understood in Silicon Valley. The organization has become a staple of the software VC community, applying many principles that have made software VC a success to founders and companies at the earliest stages of company formation. Many of YC’s bets are made so early that the org has been known to make bets on attractive founding teams with no workable company idea yet.

But Tony Kulesa’s Substack piece provided enough perspective to see the YC model in a different light than it is usually seen in: YC as a sum of its goals. Tony writes the following on what early YC was gearing itself to do:

One could summarize YC’s structure:

Invest in young, smart, energetic, and determined hackers

Give them enough money to pay for living expenses, but not much more

Give them a few months to build something, launch it, and see some evidence of growth

And, since finding good ideas is hard, get statistics on your side by batch processing – run as many of these experiments as you can in parallel.

The specific resources that YC chose to provide were those that allowed for fast experimentation and proof-of-growth. Considering the 'YC model' as a set of goals — rather than a set of resources — has interesting implications for one notable area in which modern VC approaches have generally not worked well: deep tech. Satisfying YC's original goals in the realm of deep tech, for most market sizes and technology areas, has proven significantly more challenging than in the realm of software entrepreneurship. Some areas, such as biotech, have found some level of success — although not on the level of software VC. But, in general, VCs have had limited success in the realm of deep tech in comparison to their software efforts.

Tony’s piece helps the reader understand exactly how the early goals of YC and the principles on which the org was founded subsequently led to the org growing into the basket of services and resources it is today. YC’s initial goals paired with the specific market and specific technologies that surround software businesses led to the YC in its current form. But, it should be remembered, had the nature of the markets and technologies that surround software businesses looked different, then the YC model could have turned out completely differently. It is this framing that I’d like the reader to keep in mind as they read today’s piece.

Today’s piece proposes a new model of deep tech VC that seems to satisfy the same goals YC had at its inception, but looks completely different from the current, largely software VC-inspired models of deep tech VC. The specific structure I propose is inspired by some of the research organizations that helped drive the effective deep tech research and commercialization pipeline of the mid-20th C. United States.

The model I propose seeks to pair the practical problem selection and cost-efficient problem solving of entities like the early GE Research Lab, Bell Labs, and MIT’s 1920s Technology Plan with a modern understanding of risk capital. In the natural course of operation in each of those three labs — and many like them in the era — each ended up with technologies that could have been ripe for spinoff as their own independent companies. In many cases, the course of research en route to one of these potential spinoffs was a cash-flow-generating activity in and of itself. In this era, while America did have refined systems of deep tech problem discovery and technological development that are jealousy-inducing by most modern standards, it often did not have financiers willing to give money to businesses with moderate chances of failure the way modern venture capitalists are quite comfortable doing.

The model I propose builds on the formulas of these three research organizations and seeks to facilitate the creation of companies that originate with non-zero customer bases and few technical risks. I am calling the model the William Walker model of deep tech VC. Walker was a key leader of MIT’s Technology Plan and a pioneer in the field of chemical engineering practice. In both an applied scientific and an administrative capacity, Walker’s career makes him an ideal namesake.

The William Walker model is not dependent on a few bets “returning the fund” as is often the case in software VC. Instead, it depends on starting good, moderately sized businesses and ensuring that as much of the R&D process as possible can generate its own cash-flow.

The rough order of the piece will go as follows:

I’ll introduce the problem further.

I’ll (briefly) outline some market dynamics that separate deep tech companies from software companies.

I’ll explore some of the history of the three research organizations I mentioned — and 20th C. deep tech in general — that inform this model.

Lastly, I’ll outline how the William Walker model for incubating deep tech companies can satisfy YC’s original goals given the more constrained financial fundamentals of deep tech companies.

If any of Tony’s readers are visiting FreakTakes for the first time today, great to have you! If you’re a regular FreakTakes reader who hasn’t read Tony’s work before, check out his Substack!

This piece, as always, is done in partnership with the Good Science Project.

Back to the action.

It's no secret that the deep tech VC industry is still looking for a model that sticks. Their 21st C. efforts, largely inspired by software VC approaches, have not generally achieved the desirable returns or societal impacts they were looking for. One possible reason for this might be that software VC-type approaches were just not built to service the vast majority of deep tech companies. The structure of many deep tech VCs — when considering Tony’s piece — may be more in line with a formula that mirrors YC's current offerings than a formula put together to accomplish YC’s original goals for deep tech founders.

But I don’t think this means we can’t hope to start deep tech companies in bulk the way we’ve learned to do with software companies. It just seems that the model has to look different. In finding a model of deep tech VC that seeks to satisfy the spirit of YC's initial goals for deep tech founders, the approach of the William Walker model is very different from software-focused VC. But that should not be surprising. Achieving similar goals in two very different problem areas can often require two very different solutions.

Proposing this model does not mean it can or should be a replacement for all current models of deep tech VC. For certain (specific) problem areas, modern deep tech VC approaches work well. But, as Tony pointed out in his piece, the status quo in most areas of engineering and science is many thousands of PhDs entering into job markets with few opportunities to use their expertise and energy to start companies.

My solution is one aimed at putting as many of them to work profitably solving problems for American industry as possible.

Tony’s Framing of YC’s Goals

The two major things early YC hoped to provide its founders shelter to pursue were:

Fast experimentation

Proof-of-growth

In the case of YC and software startups in general, it turns out that a modest financial package and access to a network of ongoing advisory relationships are more than enough to facilitate both of these. In fact, they work so well that, to many in the Valley, a pile of money and advice is what has become synonymous with the ‘YC model.’

And, while that is what YC is doing now, thinking only of these specific resources as the formula to achieve YC’s two goals is probably overfit to the special case of software startups.

The Different Market Dynamics of Deep Tech

When we take a step back, it’s maybe a bit strange to assume that some variant of the financing model that proved optimal for software startups would prove optimal in the general case. The (simplified) examples of products that can be scaled with the most negligible costs that one finds in Econ textbooks are software and certain chemicals/drugs. Additionally, most software companies have the added benefit of negligible technical risks when compared to startups in the hard sciences. Frankly, most scientists would be insulted if you compared the technical risks involved in constructing something like Uber’s early product to what they were working on.

It’s wonderful that a lever as straightforward as a modest amount of capital can facilitate new company formation in an area like software entrepreneurship — as long as the potential market is large enough. But the dual factors of negligible technical risk (when compared to the hard sciences) and (relative) ease of scaling make software a relatively easy industry to enable via venture capital. Much of the modern software VC industry has structured itself with these dynamics in mind. In fact, as I understand it, the closer the fundamentals of a would-be biotech company are to that of a VC-attractive software startup (in terms of market size and ease of scaling), the more likely it is to get funding. And that makes sense. These dynamics make for fantastic VC investments! When markets have these dynamics, the current VC model works great.

Even a deep tech company like Varda is heavily leaning on these dynamics in its monetization strategy. Varda, the space bio-manufacturing company which Not Boring Capital announced an investment in last month, aspires to be a generalized space manufacturing company. In general, companies in the defense/space spaces are already more VC-investable because something like a $60 million Air Force contract can offset much of your early-stage R&D costs — if you can clear the bureaucratic hurdles to winning a government contract. Even with that contract in place, the initial product that Varda is looking to manufacture that makes their future balance sheet more ‘venture-scale’ is drugs. Drugs have the extremely high margins (and low weight) needed to make this a solid VC investment. And, with all that and a great team in place, Varda does seem to be an extremely compelling investment for deep tech VCs.

But that is also a lot of pieces that needed to come into place. The markets Varda is serving in the short and long run are all very special cases. The joint vertical of “space drug manufacturer that wins defense contracts to offset R&D costs” is an unbelievably specific category that was seemingly made in a lab to be a VC-investable bet. (It should probably be unsurprising that Delian Asparouhova, Varda’s co-founder, was a VC before starting Varda.)

The number of potential deep tech companies that can meet the financial criteria that venture-scale software companies are able to meet is absolutely minuscule. This group of possible venture-scale deep tech companies is absolutely dwarfed in size by the number of hypothetical companies out there that technical researchers are suited to pursue. The following chart from a 2018 MIT report will not shock you. Certain kinds of companies in certain fields are flourishing. But it is a special set of companies that utilize a specific sliver of MIT’s talented alumni.

As you can see, there is a very large (and growing) pool of ambitious, talented scientists and engineers that have few opportunities to use their degrees to start companies. More/slightly different structures on current VC models is one solution that could certainly solve a portion of the problem — which is what often gets talked about. One such example of a small modification to current models would be earlier/more frequent engagement with applied professors at land grant universities who frequently work on applied research contracts for industrial customers, but are not otherwise involved with the VC ecosystem. However, for most would-be founders and companies, deep tech VCs — in their current form — are just not offering the right set of resources to start a company in their field.

‘Jet fuel’ is not right for every problem in the short run. But YC’s initial principles, which led them to the specific resources they currently offer software founders, may lead us to the right bundle of resources for a larger pool of would-be deep tech founders.

A Model Inspired by MIT’s Technology Plan & 20th C. Industrial R&D Labs

An effective model to support these technical founders and their ventures does not necessarily need to be as profitable as software VC in as short of a time horizon, but it should aspire to be profitable. Additionally, the model should make use of both the learnings from the last five decades of development in the VC industry as well as the well-functioning deep tech pipeline of the early/mid-20th C. United States. After all, before the boom in software/EE/biotech startups, deep tech was not even a phrase. For the most part, all tech was deep tech.

As Tony framed it, YC’s goals were to provide founders with the right resources for fast experimentation as well as proof of growth. For the case of deep tech research, we can maybe fiddle with these to instead be labeled 1) many rounds of experimentation and 2) product-market fit.

In most areas of science, of course, rounds of experimentation are both longer and more expensive than in software. In most cases, it’s not profitable for a venture capital firm to rain experimentation money on a researcher and see what happens. Additionally, many PhDs are not schooled enough on the business side of technical ventures to know how/where to shepherd their resources and efforts. This is noteworthy because false starts and wide pivots are far more expensive learning experiences in deep tech than in software.

Interestingly, labs in the early/mid-1900s US dealt with these issues quite well. These labs possessed great systems for exposing top researchers to all sorts of nitty-gritty problems and profitably carrying out numerous rounds of experimentation on those problem areas. These systems — while they did go away for various reasons unrelated to their profitability — were generally seen to be effective and profitable. The two most notable examples are large industrial R&D labs and the portions of universities (particularly land grant universities) dedicated to applied research. Entities I’ve covered on FreakTakes such as the early GE Research Laboratory, Bell Labs, and early MIT’s Technology Plan typify the models to which I refer.

I encourage you to check out each of the pieces to understand the approach of each lab in depth. But, in short:

Bell Labs had a fantastic system of exposing its researchers to problems all across Bell’s operations — including the day-to-today problems of its manufacturing entities, implementation staff, and elsewhere. Researchers’ regular interactions with people and problems from all parts of the enterprise were not serendipitous, but an intentional outcome of Bell Labs’ management. Researchers at Labs had it instilled in them that it was “a matter of individual responsibility” to find problems that paid off for Labs. Bell also did not rely on researchers to find just the right problem by themselves. Bell maintained a corps of “systems engineers” to ensure that its researchers were shepherded towards the profitable/useful problems that researchers found interesting (and not just any random problem they found interesting). Bell’s engineers and metallurgists being systematically exposed to ideal research problems — such as the fact that a billion maintenance dollars a year were being spent on fixing a specific kind of wire that degraded in certain climates — was no accident. Bell’s leaders knew their systems of problem exposure and selection were the secret sauce that allowed them to effectively deploy their research talent.

The GE Research Laboratory, similar to Bell Labs, had excellent methods of problem identification. Like many applied research groups at the time, they were also excellent at brute force experimenting their way to the solutions to the right problems. But the lab also had a fantastic system of managing its basic researchers — such as Irving Langmuir — by granting them what I call a “long leash within a narrow fence.” Langmuir was allowed to work on any basic research project he wanted…so long as it was directly related to a project already underway on the applied side of the lab. His arbitrary selection of bulb vacuums — even though he could care less about the practicality of the project — led him to findings that would not only win him a Nobel Prize in what would come to be known as surface chemistry, but also cut the energy usage of GE’s bulbs in half while tripling their shelf life.

MIT, while short on cash in the 1920s, implemented a program called the Technology Plan. MIT’s Technology Plan carried out industry research contracts and consulting work in order to subsidize the Institute’s other research activities. The work was not ‘consulting’ in the style of today’s ‘management consulting,’ but, rather, more in the style of early-1900s engineering or research consulting projects. Companies came to the departments with concrete technical needs, and MIT researchers would often deploy their experimental skills and scientific knowledge to find a solution to the problem. The program was enormously profitable. At one point, 6/7ths of MIT’s Applied Chemistry department’s funds were coming from Technology Plan contracts. Many researchers even preferred this work. Industry’s problems were often interesting. And MIT staff got to use their brains to figure things out for actual businesses with pressing problems that were so important that the businesses were willing to pay a premium to have them solved.

The (very) general ingredients that these programs had in common were:

They had a pool of talented researchers excited to work on interesting, applied problems.

They each had a system of exposing their researchers to profitable, interesting problems.

They effectively paired researchers to short-term problems they were well-tooled to solve.

The labs deployed the day-to-day efforts of their researchers on near-term problems that were profitable to some business. The researchers were shepherded to these problems and, over time, learned to identify good problems for themselves in their industry. Each lab encouraged its researchers to do additional exploratory research related to potential customer problems. Each lab also had technically competent, business-savvy individuals who sourced customers, contracts, and problems for the researchers.

While working on problems in this ecosystem, the researchers learned the ins and outs of their industry and how their work could profitably fit into it. Many times, when attempting to solve a smaller-market problem for a customer, researchers would stumble onto a course of research that solved a much larger-market problem. Often, this also happened when researchers used excess funds to pursue problems of their own interest. Those same individuals who sourced problems/consulting work often sourced initial customers for new discoveries that came from the labs’ exploratory research.

Of course, none of these research organizations were explicitly aimed at creating startups. The industrial R&D labs were dedicated to servicing the research needs of the large organizations to which they were attached. MIT’s Technology Plan carried out industry research contracts and consulting work in order to subsidize the Institute’s other research activities. But the scaffolding and organizational structures these labs erected provide a clear template for a modern organizational structure that could meet both of the goals of the original YC model in the deep tech space.

By pursuing continuous research consulting style contracts, an organization could offer hopeful technical founders the chance to continuously experiment in areas that many businesses objectively need help in and are willing to pay for. One-off problems that require research consulting that are brought to the org could provide industry experience and experimentation resources to the pool of researchers — who would all be aspiring deep tech founders. And any solution that members of the org develop that has a more general use can be taken by interested lab members and spun off into its own company. The goal of the contracts would be as a ‘break-even search function,’ not a profit generator in and of itself. Contracts should be viewed as ways to learn an industry or provide excess funds for experimentation. The endless ‘selling work’ that management consultants do should not be incentivized. Uninteresting and needless projects are unlikely to lead to new company formation.

The 20th C. models I have outlined went away, but they were financially sound and made sense. William Walker, who headed the MIT department that coordinated research contracts and brought in customers, once said, “There could be no more legitimate way for a great scientific school to seek support than by being paid for the service it can render in supplying special knowledge where it is needed.” This was not Walker paying lip service to some concept he didn’t wholly believe in. He would go down as a pioneer in many areas of the young field of chemical engineering practice largely because of his applied contracting work with industry.

Emphasis on the Technology Plan program faded over the years because, to many in the MIT administration, it came to be seen as a program of necessity. MIT was going broke, but a time came when they no longer needed the money. Most modern universities would not be well-suited to attempt to bring this model back. As Corin Wagen — who received his PhD in Chemistry at Harvard — noted in a blog post last year, nowadays it is common that “policies like [Harvard's] prevent companies from hiring research labs on a purely transactional basis, forcing academics to decouple their incentives from those of industry…research groups cannot simply remake their interests to suit whichever employer they want to attract.”

Universities are not pursuing goals that are anti-industry. But, at many top universities, it has become much much harder, over the decades, to explicitly align one’s research goals to be directly in service to industry — as the entire institution of MIT once proudly did.

But an entity like the model of deep tech VC I describe could be ideally suited for such a task.

Modern Risk Capital Could Take This Model to Another Level

These early-1900s orgs clearly had effective scaffolding for sourcing problems and profitably coming to solutions in markets that did not have software-style fundamentals. But what their researchers absolutely did not have was access to risk capital that is anything close to what we have today. A 1997 BankBoston report on the status of MIT-related startups demonstrates the extreme extent to which, even in the later-1900s, technical founders usually had to bootstrap their companies through immediate cash-flow positivity or their own savings.

If a researcher wanted to leave MIT or some company’s R&D department to start a company related to their work, financial institutions were not much help. This was often true even if the IP on which the business was based had been technically de-risked and warm relationships with potential customers were in place. (Also, on the point of IP, to leave Bell Labs to spin off a piece of technology was no small thing either. On one’s first day at Bell Labs, employees signed an IP agreement signing over all IP created over to Labs for $1…)

70 years ago, it was extremely difficult to spin off many great and (mostly) technically de-risked ideas because the state of capital financing was not where it is today. Today, we have a different set of problems. Our corporate R&D labs in most industries have taken a step back in how “basic” their research is. Meanwhile, what universities call ‘applied’ research has become much less applied than it used to be. This ‘middle’ of the deep tech pipeline has been hollowed out.

The mere availability of $2 million VC checks is not enough to bring most could-be companies into existence. Practical entrepreneurial knowledge gaps aside, most technical ideas are not meant for “jet fuel.” In the BankBoston dataset of MIT companies, 7/8ths of them remained under 100 employees 15 years into their existence. Many were planning expansions in various ways, but in a modest sense. With friendlier capital markets, some surely would choose to expand more aggressively. But most probably wouldn’t. Most markets are only so big. This doesn’t mean technical ventures with modest initial market caps can’t grow massive, they just might do so on a different time horizon. As the report pointed out, “Of the 17 largest firms [with 10,00+ employees in the dataset], all but 5 were founded by students who left MIT more than 50 years ago and none were founded by those graduating in the last 30 years.”

This was the traditional route to mega-unicorn status. Companies learned to effectively serve some target market for 5-10 years and gradually expanded as the decades wore on — some until they were as massive as Koch Industries. Modern risk capital can surely speed up this process, but it is a process that surely will take longer than the 10 to 15-year time horizon of many current VC funds.

Also, most likely, the base rate of unicorns in deep tech will be smaller than in software. But there seems to be a way to mitigate that issue from a financial standpoint. Even if the base rate of unicorns and mega-unicorns in deep tech is smaller, it’s very possible that the mid-20th C. inspired model could lead to a much higher base rate of break-even and moderately profitable companies than is seen in software VC. Looking at the 2018 MIT report (with data on MIT-related companies from 1940 onward), it seems only a minority of these MIT businesses failed in the first 5-10 years (possibly as little as 20% of businesses after 5 years and 30% after 10). While the data are possibly crude and no specific number should be trusted too closely, a failure rate this low may not be so surprising given that so many of the companies were being started by those who knew an industry well and began the companies’ life cycle with immediate cash-flow positivity.

In summary, while the base rate of unicorns in deep tech is likely lower and it will likely still take at least 20 years for most potential unicorns to become unicorns with modern risk capital, there are ways to drastically reduce the number of investments that go to zero — with the median case being a moderately profitable company. That limited downside, combined with the upside being companies like Koch Industries, could make this model workable.

The Median Case

Most portfolio companies would never grow as large as Koch Industries, and that should be ok because the median case in this model is still extremely compelling. The median case is far more ambitious and interesting than the mere $300,000 yearly profit after expenses and salaries on its balance sheet would have you believe. A model like this has the potential to create many small, profitable technical companies that could effectively utilize the skills of otherwise underemployed PhDs and engineers. The model could help rebuild the chasm between many areas of STEM research and American industry that has formed over the past 50 years. These companies could be bastions of profitable engineering and scientific excellence, leveraging Bell-style problem finders and effective sales operations.

If they grow big, great! But if all most of the portfolio companies end up doing is collectively solving as many problems as possible and their researchers make a good living doing it…the right kind of investors might find that exciting! For that mission, they might be willing to have their money held for a longer term or be open to a different style of returns than in software VC. After all, few investors partake in deep tech VC because it is the fastest or surest way to get rich. Many, frankly, want to do their part to help America recover its status as a powerhouse of great industrial research in all technical areas.

A (brief) look at the financials

(The basic models and discussion that went into this section were worked on jointly with Aakash Pattabi, who understood better than I what kinds of simplified models would be productive for this brief exploration.)

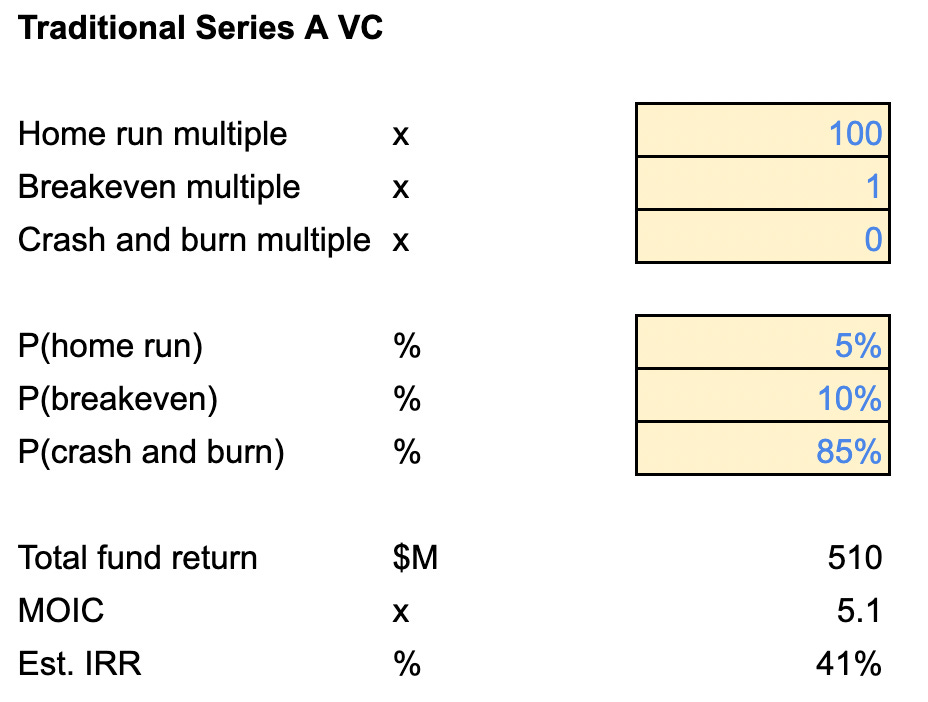

The return profile of a VC model like the one I describe, as you’d expect, looks very different from traditional software VC. The following graphic shows a simplified model of what has come to be normal in something like Series A software VC. In this style, as many know, the hits make the portfolio. Investors are happy to write off 85+% of their checks as most likely going to zero. This is ok because the big hits make or break the fund's success. In the following case, a 5% home run rate — in this case over a ten-year time horizon for a fund that writes 100 $1 million checks — can help the fund return $510 million after ten years.

That case, of course, is a case of things going extremely well. Most funds do not achieve anything close to that kind of success on average. If a VC does not find those few companies that “return the fund,” things can look much more bleak.

In the William Walker model, one can “return the fund” over a ten-year time horizon with quite modest assumptions. The returns in this basic model are much less sensitive to ‘home run’ performance than in the software model because, not unreasonably, I assume that a deep tech home run in the William Walker model might be a company 10Xing its initial valuation in the first ten years — rather than 100Xing. What performance for a William Walker model fund is much more sensitive to, on the other hand, is the growth rate of more standard companies in the portfolio. But these standard companies need not be extremely large companies. In this case, I imagine:

50% of companies achieve the goal of 50% total growth (over the first ten years) from their modest initial valuations

15% of companies achieve moderately ambitious growth goals, 3Xing their initial valuations

5% achieve 10X valuations

And 30% of companies crash and burn

With these assumptions, we observe a return profile that is almost comparable to buying and holding index funds.

The assumptions and outcomes in this hypothetical scenario are only to give the reader an idea of the thought process and goals that one would have if they were looking at this model as an investor who wanted to match stock market returns. Of course, one would need to deploy this “experiment” in the real world to observe what truly realistic assumptions actually are.

It could go wildly well. The following is a version of the model that would justify scaling the model with reckless abandon if proven true. These (still not crazy) assumptions imagine the following over a ten-year time horizon:

Home runs were 1/5th the growth rate of software companies rather than 1/10th

Moderately ambitious growth multiples are 5X rather than 3X

And the base growth rate was a company 2Xing in 10 years rather than 1.5Xing

With that, the ten-year return on the fund is $275 million on a $100 million investment.

Things could go even better than this model. For example, the Fraunhofer-Gesellschaft — Germany’s system of applied research institutes that serve a similar function to what the Max Planck institutes are for German basic research — report a survival rate of 90% after five years for their spinoff companies. A crash and burn rate far below the 30% number I used in the model could make the financial outcomes even more compelling.

Of course, there exists a world where this could also go very poorly from an ROI perspective. As you’d expect, the worst possible scenario is one in which the companies have a crash and burn rate similar to the hit-or-miss world of software VC — where companies are encouraged to swing big by design. The following graphic shows a version of this going badly, with half of investor money disappearing. With the same return multiples that netted a $170 million total fund return on $100 million invested, the following assumptions yield a very different financial outcome:

There are no home runs

5% of companies grow moderately ambitiously (rather than 15%)

25% of companies grow by 50%

70% of companies fail

If one picks investments that go to zero too often, then this is not viable. But if one picks businesses that — as the old MIT-style companies were — are almost immediately cash-flow positive and launch with customer bases and warm leads, then the model is extremely compelling. This is why the pivotal first step in making this a profitable investment class is a style of labs and consulting contracts similar to MIT’s Technology plan, Bell Labs, or early GE Research. These environments produced engineers and scientists whose ideas and ventures could be considered ‘safe bets.’

There would naturally be many small differences in the operation of this model that differ from software VC. One would imagine that — as in the early era of Silicon Valley when VCs were funding more chip/hardware companies — William Walker funds might take a higher percentage of the companies they invest in than is normal in software and, if need be, write fewer checks to ensure companies have the resources they need from the start. This is a reasonable approach when one assumes that far more of its companies will survive the early years than in software VC. Additionally, dilution of one’s equity is a much more negligible factor in this style of VC. Lastly, the styles of businesses being launched would be much more capable of issuing things like yearly dividends to investors. So, even if exits to financial actors like search funds of low-to-mid-market PE firms take a while to materialize, some liquid returns can be seen in the interim.

There is a chance that the William Walker model turns out to be attractive in its own right from the POV of a self-interested investor. But this “experimental” fund idea should be extremely compelling, in particular, to the affluent groups that have, to this point, been losing money in an effort to fund technological growth. Many of these individuals have either been directly funding research through philanthropic giving or been contributing large amounts to ambitious deep tech VC projects knowing the investments are not as profitable as alternative investments.

Investing in this model has the potential to:

At the minimum, bring into existence a new style of org where under-employed, top minds can start companies that solve the problems of American industry even if they are only modestly profitable.

Possibly prove out an extremely profitable model of VC. And, even if it doesn't, the organization would have an extremely high chance of breaking even as an experiment — as opposed to many experiments that have no chance of returning the donor’s money back to them under any circumstance.

Maybe this is an experiment that launches a new area of venture, or maybe it just turns out to be a new and clever way to enable top research minds to generate industry solutions — but doesn’t work as a for-profit company. Regardless, it is an experiment worth running.

An ‘Old New Model’ for Deep Tech Venture

This alternative approach to deep tech VC has the potential to marry the best of the old and new. On the day-to-day, doing consulting project work like that of MIT’s Technology Plan projects or Bell Labs-style assignments could bring in money and experience. This provides would-be deep tech founders runway to experiment and on-the-job industry know-how. In general, the goal of the org should be to produce profitable new companies in the long run while (at least) breaking even in the short run on its contracts. When they spin off, the companies would ideally be further along than many deep tech investments currently are — originating with a non-zero customer base and fewer technical risks.

In that case, providing risk capital to the spinoff for 25% of its equity could be (very roughly) one-third as likely to go to zero as the standard deep tech check currently. Each of these successful, break-even companies is one less hole in your balance sheet and one more chance at a company that, in the longer run, can grow into a mega-unicorn like Koch, Gillette, or (even) Campbell’s Soup did in the MIT data.

Not all university labs, of course, have forgotten how to do this style of work. Certain PIs and their labs do large amounts of applied research and continuously graduate grad students who spin off work that originated in the lab. And that’s great! Individuals just like that are the ones who should help guide an initiative like the one I’m describing.

But what those labs are doing is not the default in academia. Incentives often lead researchers elsewhere. Lab heads like these are proving that it’s doable. But we could do with a hundred more of them across many fields. The other week I spoke with a Big Ten Mechanical Engineering Professor who brings in industry contracts and whose students have gone on to collectively raise significant amounts in VC rounds. He felt that he had a much better sense of industry needs and how VCs thought than most of his departmental colleagues. I asked him if there were colleagues in his department whose labs he believed he could take over and get to the point that they were raising as much as his lab from VCs. He replied, “Several.”

I’ve also spoken to several professors at land grant schools who took over academic labs after having worked in industrial research for a portion of their careers. Even after transitioning into academia, the industry from which they came continued to lean on their research and hiring the grad students they trained. In various ways, they’ve all (politely) said that most researchers in academia just don’t really understand how to make themselves and their work genuinely useful to industry while working at a university. Their incentives and training seem to lead them elsewhere.

All of these stories point to an opportunity! The William Walker model can take advantage of top research minds to solve very different problems in a very different organizational structure that is built to train future founders, preserve investor capital, and serve industry as its main goal.

The right combination of older researcher/advisors and (the right) big-name financial backers could surely provide sufficient ‘signal’ so that some early customers with interesting projects would be willing to come on board. After all, the brands of people like Eric Schmidt have come to extend beyond the borders of Silicon Valley. And there is also a subset of applied-minded professors already known to produce novel, profitable research within their own industries. This William Walker model of deep tech VC, in its early years, could leverage both of these reputational signals to bring in early projects and get the experiment off the ground. (Of course, the young entrepreneur/researchers would do the lion’s share of the actual work on the projects, but an initial stream of projects would be vital to get the experiment off the ground.)

It would be ideal to set up a full William Walker-inspired org, from the start, that was equipped with full-time research heads to lead contracts, a small research facility, a pool of capital to invest in spinoffs, and full-time research staff who aspire to be entrepreneurs. However, if it were more workable, there are more measured approaches to help the org “ramp up” to full capacity. At the minimum, the org should start with:

Salaries and facilities for the full-time research staff (who are hopeful entrepreneurs). The number of research staff could be small — around three to five people — if the org decided to focus on one specific area of research consulting and spinoffs.

(At least) part-time research heads — who would often be university PIs — who have experience working with industry contracts and could bring in initial contracts on which the full-time research staff could get started working.

Access to some form of capital that is excited about the experiment and willing to invest in the spinoffs of the research staff. If the William Walker org does not have a fund itself, it should establish some form of relationship to friendly capital pools that lead the org to believe investments in deserving spinoffs should materialize. However, since outside capital may be timid, it would be best if the org could initially raise at least a small fund to ensure it has enough money to invest in the first couple of spinoffs.

Other variations of this could work, but as much as is possible, no half-measures should be taken when it comes to the research staff. The potential entrepreneurs should be spending all of their time on this — it shouldn’t be some side-show to other work they are doing.

One could try to change academia to better correspond with these goals so professors and labs strive towards them more often — rather than tenure or filling amorphous ‘holes in the literature.’ One could also try to restructure large companies to more effectively pursue exploratory research and, when appropriate, cleanly spin the work off with a friendly deal and minimal IP annoyances.

But an entirely new organization dedicated to the task is probably best. Specifically, an org that is:

Inspired by early YC’s goals

Deploys the structures of early/mid-1900s applied research orgs

And leverages the learnings of modern risk capital

If Tony’s article is correct, it seems that YC’s original thesis was about how to “solve the money problem” for hackers, not building huge companies. Talented engineers, instead of working for some pointy-haired boss on uninspired engineering work, could take a risk and earn themselves a chance to work on cool problems with a level of financial security. That was the idea.

The same history that leads me to propose this specific structure also leads me to believe this can be done profitably. Will it be as profitable as software VC, index funds, or real estate? I’m not sure. But, as it stands, current deep tech VCs cannot promise anything like that either. This approach offers a fresh perspective, but a perspective that is based on a historically profitable approach.

As it stands, for many LPs who invest in deep tech, it is about more than just money. Many hold the staunch belief that this country is meant to be a place that feverishly produces technical innovations across all scientific and engineering areas — not just two or three! And I think so too. For the most part, it was our consistently fantastic feats of applied science throughout the 20th C. that lead us to this mindset in the first place. That’s why, to me, when attempting to structure an organization that can enable the creation of technical business ventures across all industries, America’s 20th C. systems of applied science are the first place one should turn to for inspiration.

That history, combined with our expanded systems of risk capital, lead me to this model — which I’m calling the William Walker model of deep tech VC.

It might not be as profitable as YC. But it does allow technical individuals to work on hard, useful problems. And it can give them a level of financial security in doing so. It’s a very legitimate way to satisfy the spirit of both of YC’s original goals.

So, it’s an idea worth entertaining.

Thanks for reading:)

But one last thing!

If anybody is interested in helping bring this org into existence…

I absolutely believe an organization like this should exist and would happily work with individuals excited to make it happen. I’m starting an offline list of potential markets in which researchers in the William Walker model could potentially be profitably deployed. So, if any folks do think this is interesting but don’t know exactly what specific markets the organization could start in, I’m already working on that and would love to share what I’ve come up with.

On that note, if anybody reading this works in some area like low-to-mid market industrial PE, I’d love to pick your brain on some things. In my market exploration so far, I’ve found individuals in these sorts of roles useful starting points. (My Twitter can be found here)

Lastly, since most of today’s piece was aimed at describing a new model of scientific organization, I’ve included an additional End Notes section with a couple of tamer takeaways that might be useful to existing deep tech VCs who do not intend to wholly change their model, but are compelled by the historical details contained in today’s piece.

End Notes/Tamer Takeaways

Of course, there are also ways to more easily fold the learnings from this piece into a modern deep tech VC to achieve at least some of the effect — with significantly less effort. But I wanted the chance to pitch the most extreme version of the idea first. But, of course, the learnings that inform this atypical idea can have more standard VC applications as well.

Working more closely with land grant professors who work on applied contracts

My first piece of advice is this: Deep tech VCs should establish much closer relationships with researchers who work more on applied contracts at land grant universities. Many of these professors continuously generate profitable and commercializable IP that plugs into the industrial process, but they are not necessarily plugged into the deep tech VC community.

I recently spoke to one Big Ten Material Science professor who said that when they hosted an ‘industry day,’ many companies who eventually became customers of the department’s services attended. But he couldn’t recall a single VC as having attended. Maybe one was there, but this professor couldn’t recall any. Maybe these professors’ work was not venture-scale, but I got the sense that many of their projects had never even come to the attention of a deep tech VC.

These labs are often sitting on know-how/skillsets that industries find usable and continually work with them to solve problems, but they are generally not plugged into the deep tech VC community. Relying on them to find a VC to share their learnings with/pitch ideas to is not a reliable approach.

Given how many VCs spend the majority of their time sourcing deals, having discussions with people in industries that they know have a low probability of leading to a deal, etc., it seems like these individuals should be actively sought out. If I worked at a deep tech VC fund as an analyst, I would spend a large amount of my time sourcing deals through this alternative channel if I could.

On that note…

Working more closely to help tailor projects the VC is not currently funding to be more VC-investable in the future

Many of these researchers are working on potentially commercializable problems on somebody else’s dime…use that! A VC can shape a project for many years before they are the one funding it.

I could imagine a world where a deep tech VC does something like ingratiate itself with the MIT master’s cohort. Many of those students, in a perfect world, would love to be deep tech founders. In a hypothetical world, a VC could attempt to shape the master’s thesis projects in the cohort — which the university is not as protective of as it is of its PhDs — as their projects are underway. For the (many) interested students, a VC could attempt to shape their research projects to be more VC-investable at the end of the two-year program. I could imagine this generating at least one or two noticeably de-risked investments for a VC firm. After all, as things stand, many of these students do not have much knowledge or direction in choosing initial project areas or choosing the ‘right’ next steps as the project goes on to make the project a commercial success.

These students seem to be one of the purest examples I can think of as having extreme talent and energy, but limited industry knowledge. Servicing them and their projects seems to be extremely aligned with the initial goals of YC — but for the deep tech space — as anything I can think of.

Of course, in the role of a VC, I would also attempt to informally do this with as many interested professors and their research directions as I could — years before I was even considering writing a check. Many professors are ‘over’ academia and would be happy to shape their research directions (on the NIH/NSF dime), over the course of a handful of years, to be more about solving the technical risks of a hypothetical company than upping their h-index. If I were a VC, I’d spend a massive amount of time working with them. If the issue many deep tech VCs have is that the deals coming across their table have too many technical risks than the VC is able to profitably fund experimentation to mitigate, this seems like a way to clearly be proactive about improving the quality of deals that cross your desk — if the VC takes a sufficiently long-term view.

These are just a few of the tamer learnings that come to mind that could be folded into interested VC operations right now

Thanks for reading:)

As always, I would love to speak with any readers interested in applying any of these learnings to their own organization.

Citation:

Gilliam, Eric. “An Alternative Approach to Deep Tech VC.” FreakTakes Substack. 2023.

Interesting piece! The types of companies you talk about fostering make me think of the the German Mittelstand companies, which are often highly technical, innovative and focused on dominating niche markets. They also create mutual interdependence between the company and its employees. I think the American way of creating would be employee options, which it seems to me are underused outside of the startup/tech world.

Really like the direction of this piece. I think you could make it even better by condensing it into shorter form and then spending more time trying to make concrete what your recommended approach would be. I am picking up three threads… A. having companies be more profit focused or at least have a mix of research and profitable projects. B. Have universities try to be more revenue generating via their research. C. Have corporate work more closely with universities, students, and projects (although the blocker here seems to be on the university side and incentives).

Perhaps another argument is that VCs need to be less diversified, perhaps even to the extent of the VC being CEOs or operators of the companies or at least being more closely involved . The problem for VCs with deep tech is that the returns are just lower and maybe the only way to combat this is to reduce the variance in returns by being more focused (although from a population viewpoint, there will obviously still be variance, and I’m not sure if this ultimately improves the risk reward ratio). But maybe the variance of returns from deep Tech companies – at some level – is indeed lower and that is where the opportunity lies in getting that better ratio by reducing diversification.